Discovering the Value of Bullion Gold and Precious Metals

The world of precious metals is both fascinating and financially rewarding, with bullion gold standing out as one of the most sought-after investments. As a tangible asset, gold bullion represents a safe haven during economic uncertainty, making it an essential component of any diversified investment portfolio. In this article, we will delve deep into the world of precious metals, exploring the intrinsic value, investment strategies, and market trends associated with gold, silver, platinum, and palladium bullion.

Understanding Bullion Gold

Before we dive into the benefits and nuances of investing in bullion gold, let's clarify what bullion entails. Bullion refers to precious metals that are produced in large, uniform bars or other forms and traded based on their mass and purity rather than their form. Gold bullion typically comes in various forms, including coins, bars, and ingots, offering investors a multitude of options.

The Historical Significance of Gold Bullion

The significance of gold extends beyond its physical properties; it has been a symbol of wealth and prosperity throughout human history. Ancient civilizations prized gold for its beauty and rarity, using it in religious artifacts, jewelry, and as a medium of exchange. Today, understanding the historical context of gold helps investors appreciate its enduring value.

Benefits of Investing in Bullion Gold

Investing in bullion gold comes with numerous advantages, which can help secure your financial future:

- Hedge Against Inflation: Gold has been proven to retain purchasing power even during periods of high inflation, making it a reliable hedge for investors.

- Liquidity: Gold bullion can be easily bought or sold in markets across the globe, ensuring investors can access their capital quickly.

- Global Acceptance: Regardless of location, gold is recognized and valued worldwide, making it a versatile investment.

- Portfolio Diversification: Including gold bullion in your investment portfolio can reduce risk and improve overall returns.

- Physical Ownership: Unlike stocks and bonds, owning physical bullion gives investors tangible assets that can be stored securely.

The Types of Bullion Gold Available

Gold bullion is available in several forms that cater to various preferences and investment strategies:

- Gold Coins: These include well-known coins like the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand. Coins generally carry nominal legal tender value, which can enhance their collectible aspect.

- Gold Bars: Available in various weights, gold bars are typically more cost-effective in terms of premiums over spot price when compared to coins.

- Gold Rounds: Similar to coins but not considered legal tender, these rounds are often sold at lower premiums than coins.

Market Trends in Bullion Gold

Understanding market trends is crucial for any investor. The price of bullion gold can be influenced by various factors, including:

- Economic Indicators: Unemployment rates, interest rates, and inflation levels can directly impact the demand and price for gold.

- Geopolitical Events: Wars, political instability, and economic sanctions can lead to increased demand for gold as a safe-haven asset.

- Supply and Demand: The balance between how much gold is mined versus how much is bought can influence pricing; less supply with high demand typically leads to price increases.

Investment Strategies for Buying Bullion Gold

To maximize returns and minimize risks, consider the following strategies when investing in bullion gold:

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, which reduces the impact of volatility over time.

- Buy and Hold: Purchasing and holding bullion for the long term can be beneficial, especially during times of economic uncertainty.

- Diversification: Don’t put all your eggs in one basket. Include a mix of assets within your precious metals portfolio.

Exploring Other Precious Metals

While bullion gold is the focus, other precious metals like silver, platinum, and palladium also offer unique benefits for investors:

Silver Bullion

Silver is often considered a more affordable alternative to gold. Investing in silver bullion can provide cash flow through its industrial applications, as it is essential in many technologies and manufacturing processes. Silver coins and bars are popular forms of investment, with the Silver American Eagle and Canadian Silver Maple Leaf being notable examples.

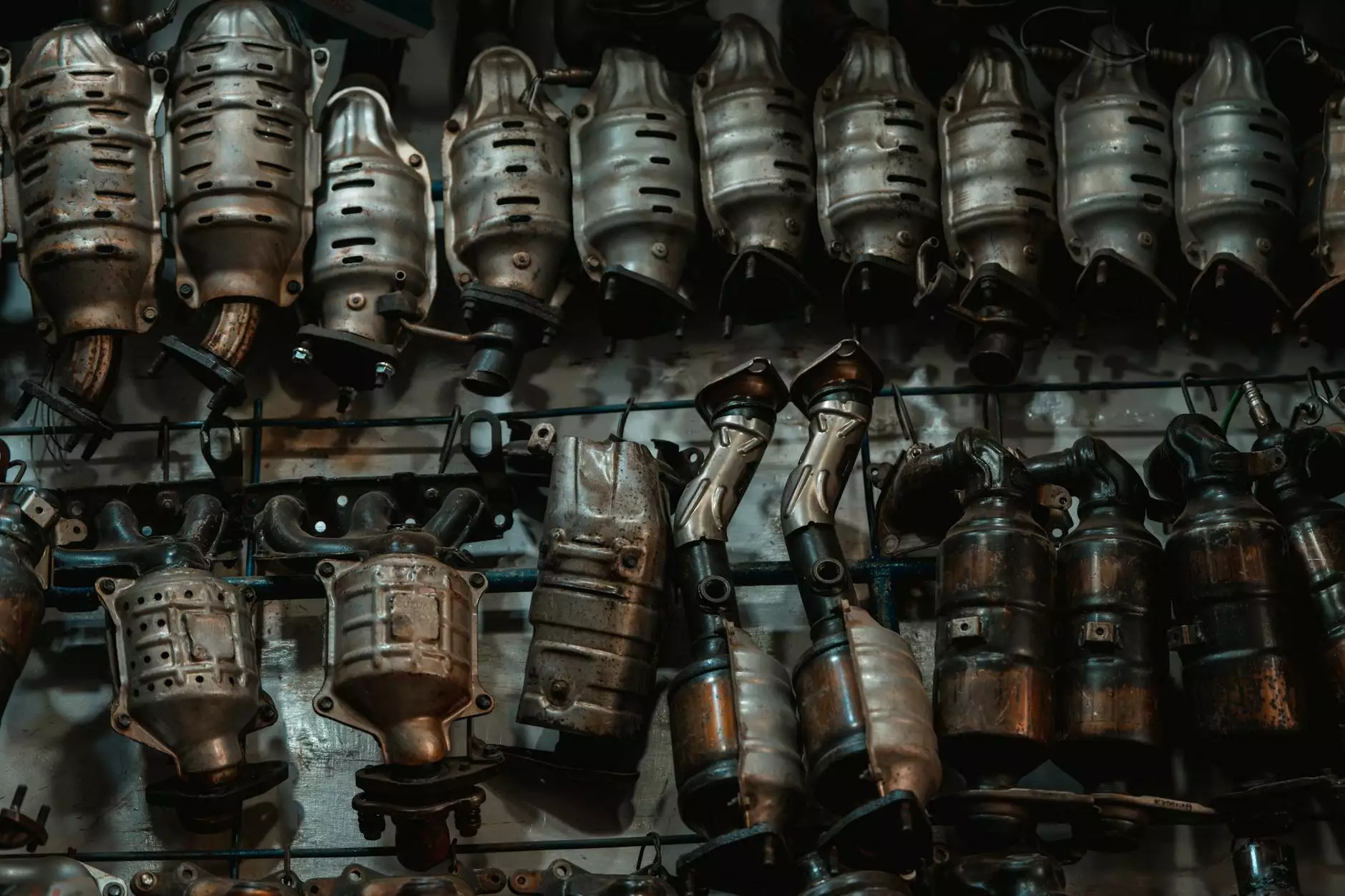

Platinum Bullion

Platinum is rarer than gold and can be a lucrative investment opportunity. Often used in automotive catalytic converters, platinum is affected by industrial demand more than gold. Platium bullion is sold in various forms, including coins like the American Platinum Eagle and bars.

Palladium Bullion

Palladium has gained popularity in recent years due to its critical role in the automotive industry for emissions control. Similar to platinum, palladium can be impacted by supply chain issues and technological advancements. Investors can purchase palladium coins and bars to diversify their holdings further.

Where to Buy Bullion Gold and Other Precious Metals

Finding reliable sources for purchasing bullion gold and other precious metals is essential. Here are some options:

- Reputable Dealers: It's important to research and choose dealers that have a solid reputation for fairness and transparency.

- Online Platforms: Companies like donsbullion.com offer extensive options for buying bullion online. Ensure they provide clear buying instructions and secure payment options.

- Local Coin Shops: Visiting a local dealer can allow you to inspect the bullion firsthand before purchasing.

Storing Your Bullion Gold

Once you've invested in bullion gold, safety becomes paramount. Consider these storage options:

- Home Safe: For smaller quantities, a high-quality home safe can provide secure storage.

- Safety Deposit Box: Banks offer safe deposit boxes for storage, creating a secure option away from home.

- Professional Vault Services: Certain companies specialize in storing precious metals in high-security vaults, providing comprehensive insurance options.

Conclusion: Investing in Bullion Gold for a Secure Future

In summary, understanding the value of bullion gold and other precious metals is more than just recognizing their physical beauty; it’s about recognizing the financial security they can provide. By investing wisely, diversifying your portfolio, and staying informed about market trends, you can confidently navigate the world of precious metals. Whether you are looking to hedge against inflation, diversify your investments, or simply safeguard your wealth, bullion gold presents an appealing option. Start your journey toward financial stability through precious metals today!